- Kistpay Shines at Digital Foreign Direct Investment Forum 2025

Showcasing Innovation

Kistpay Shines at Digital Foreign Direct Investment Forum 2025

Advocating for Digital Inclusion on the Global Stage

Kistpay Shines at Digital Foreign Direct Investment Forum 2025

Advocating for Digital Inclusion on the Global Stage

May 2, 2025

Kistpay (Private) Limited proudly marked its presence at the Digital Foreign Direct Investment Forum (DFDIF) 2025 in Islamabad—an influential gathering of global leaders, regulators, and tech pioneers committed to shaping the digital economy of tomorrow.

Our Founder & CEO, Asif Jafri, and Co-founder, Syed Amir Jafri, represented Kistpay in key conversations with government officials, international investors, and ecosystem enablers, spotlighting our mission to advance financial and digital inclusion for underserved communities across Pakistan and beyond.

The Kistpay team also showcased our innovative fintech solutions, which received strong interest and appreciation for their impact in driving affordability, access, and digital equity.We extend our gratitude to the Government of Pakistan, Ministry of IT and Telecom, Pakistan Software Export Board (PSEB), and the Digital Cooperation Organization (DCO) for organizing this vital platform to foster collaboration, attract foreign investment, and accelerate digital transformation.

- Kistpay Engages Future Innovators at Developers’ Day – ACM NUCES 2025

Empowering Communities

Kistpay Engages Future Innovators at Developers’ Day – ACM NUCES 2025

Connecting with Bright Tech Talent at FAST University, Karachi

Kistpay Engages Future Innovators at Developers’ Day – ACM NUCES 2025

Connecting with Bright Tech Talent at FAST University, Karachi

April 18, 2025

Kistpay (Private) Limited was proud to participate in Developers’ Day – ACM NUCES 2025 at FAST University, Karachi—a vibrant gathering where innovation met ambition.

The event served as a powerful platform to engage with Pakistan’s next generation of tech talent, spark conversations around digital transformation, and explore the role of inclusive innovation in shaping smarter, more connected futures.

Our dynamic HR and Tech teams had the opportunity to connect with brilliant students, exchange ideas, and share insights into the transformative work Kistpay is doing to drive digital inclusion for the Next Billion Users.

- Kistpay Hosts Annual Iftar 2025

People & Culture

Kistpay Hosts Annual Iftar 2025

A Heartwarming Evening of Reflection and Togetherness

Kistpay Hosts Annual Iftar 2025

A Heartwarming Evening of Reflection and Togetherness

March 22, 2025

Kistpay (Private) Limited recently came together for its Annual Iftar 2025, uniting the entire Kistpay family to embrace the spirit of Ramadan through reflection, gratitude, and togetherness.

The evening served as a meaningful opportunity to reconnect beyond the workplace, share blessings, and celebrate the core values of unity, compassion, and community that shape Kistpay’s culture.

A heartfelt thank you to our leadership—Asif Jafri, Amir Jafri, and Sadaf Ansari—for championing a culture of inclusion, appreciation, and team-building, especially during this sacred month.

To our team members, partners, and friends—thank you for joining us and making the evening truly memorable. We look forward to continuing this journey together with purpose, unity, and shared values.

- Kistpay x PSI Empowers Rural Entrepreneurs

Women Empowerment Program

Kistpay x PSI Empowers Rural Entrepreneurs

Enabling Financial Independence for Underserved Communities

Kistpay x PSI Empowers Rural Entrepreneurs

Enabling Financial Independence for Underserved Communities

March 21, 2025

Kistpay (Private) Limited, in collaboration with Population Services International, Pakistan and JazzCash is proud to advance financial empowerment in rural communities.

During a recent activation in Sanghar, facilitated by the HANDS Foundation, local community workers embraced the power of digital inclusion by acquiring smartphones via Kistpay’s installment financing model. These smartphones now serve as essential tools for growing their small businesses and accessing digital financial services.

For many in underserved areas, a smartphone is more than just a device—it’s a gateway to opportunity. By bridging the digital divide, this initiative is helping rural entrepreneurs unlock economic potential, promote resilience, and build a sustainable future.

Together, we are shaping a more inclusive tomorrow—where no one is left behind.

- Kistpay Honored for Family-Friendly Policies

Women Empowerment Program

Kistpay Honored for Family-Friendly Policies

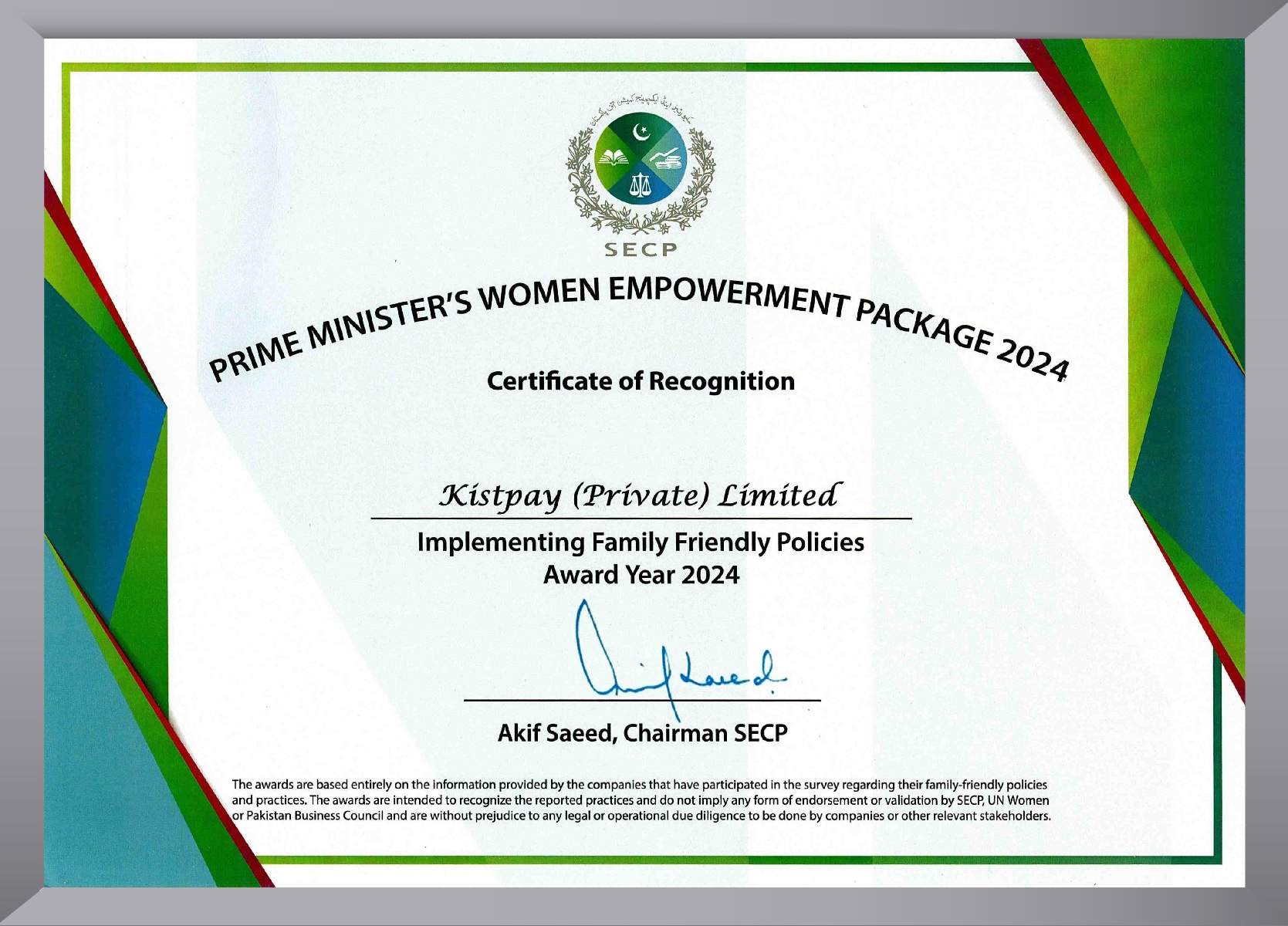

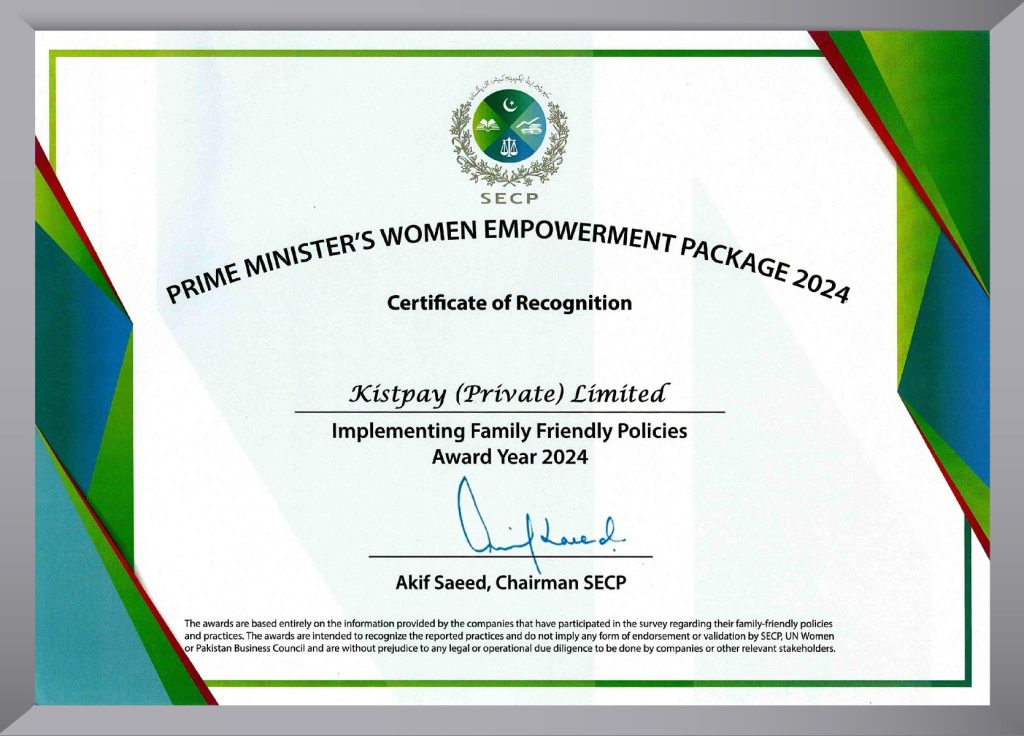

Kistpay (Private) Limited is proud to announce that it has been recognized among the Top Private Companies in Pakistan for implementing Family-Friendly Policies, as part of the Prime Minister’s Women Empowerment Package.

Kistpay Honored for Family-Friendly Policies

March 15, 2025

Kistpay (Private) Limited is proud to announce that it has been recognized among the Top Private Companies in Pakistan for implementing Family-Friendly Policies, as part of the Prime Minister’s Women Empowerment Package.

The prestigious award was presented at the International Women’s Day 2025 ceremony, hosted at the Prime Minister’s House and organized by the Securities and Exchange Commission of Pakistan (SECP) in collaboration with UN Women, The Pakistan Business Council, and the Ministry of Human Rights (MOHR).

Selected from among 230 participating companies, this national-level recognition was presented by Prime Minister Muhammad Shehbaz Sharif and SECP Chairman Akif Saeed, highlighting Kistpay’s commitment to promoting gender equality, work-life balance, and a more inclusive economic future.

This milestone is a testament to Kistpay’s consistent efforts in fostering a workplace where women and families thrive, driven by thoughtful policy-making and a culture of empowerment.

We extend heartfelt congratulations to our CEO, Asif Jafri, and the entire Kistpay team for their unwavering dedication to diversity, inclusion, and progressive workplace practices. Their leadership continues to set new industry standards and inspire positive change across Pakistan’s corporate ecosystem.

- Kistpay Celebrates Women’s Day

People & Culture

Kistpay Celebrates Women’s Day

A Commitment to Inclusion and Empowerment

Kistpay Celebrates Women’s Day

A Commitment to Inclusion and Empowerment

March 12, 2025

At Kistpay (Private) Limited, we don’t just celebrate women—we empower them.

This International Women’s Day, we proudly recognize the resilience, leadership, and innovation of the women who are shaping a better, more inclusive future.

Kistpay reaffirms its ongoing mission to drive financial and digital inclusion by making technology and financial solutions more accessible—especially for women from underserved communities. From launching inclusive initiatives to creating a growth-driven workplace, we are committed to building a world where women can thrive, lead, and innovate without barriers.

Here’s to the changemakers, the trailblazers, and every woman making a difference—today and every day.

- Navigating the Global Economic Growth

-

June 18, 2025

Navigating the Global Economic Growth

Risks and Roadmap for Recovery

Fatima Alvi

Navigating the Global Economic Growth

Risks and Roadmap for Recovery

Date: 18/06/2025

The Shaky Path of Global Growth

Just months ago, it seemed the world was emerging from a series of shocks—from the pandemic to natural disasters and geopolitical tensions. That optimism has faded. Now, global GDP growth is forecast at a mere 2.3% for this year—the slowest pace in nearly two decades outside of recession years. Without decisive policy action, this slowdown risks deepening economic inequality and derailing improvements in living standards.

Why Developing Economies Are Falling Behind

While advanced economies are expected to regain their pre-pandemic per capita output by 2027, many low- and middle-income countries will not. For these economies—especially those excluding China—per capita GDP may remain nearly 6% below where it should be. Feeling the squeeze from declining trade, underwhelming investment, and growing debt, these countries could lose two decades of economic gains unless corrective steps are taken.

Unpacking the Drivers Behind the Decline

1. Waning Momentum in Trade

Trade growth rates have progressively declined—dropping from 5.1% in the 2000s to around 2.6% this decade. This slowdown undermines the economic boost that global exchange of goods and services once provided.

2. Weakening Investment

Private and public sector investments have slowed dramatically, reducing the capital available for infrastructure, technology, and economic expansion.

3. Mounting Government Debt

Developing nations now carry deficits near 6% of GDP, with interest payments consuming a large slice of national budgets. In many places, foreign aid has also receded, escalating debt pressures and reducing fiscal flexibility.

Three Pathways to Recovery

A. Rebuild Global Trade Ties

Reducing tariffs and reviving deep trade agreements—encompassing regulatory alignment—could boost global growth by nearly 0.2 percentage points. Reinvigorating the World Trade Organization would foster a more predictable and efficient trading environment, especially beneficial for export-led developing economies.

B. Strengthen Fiscal Foundations

These countries must enhance revenue flows (around 25% of GDP on average) by broadening tax bases and improving collection. Redirecting subsidies to the most vulnerable, improving public financial management, and containing debt service are crucial to securing long-term fiscal resilience.

C. Drive Employment and Workforce Development

Demographic shifts—such as a doubling working-age population in Sub-Saharan Africa by 2050—demand rapid job growth. Investments in education and skills training can help emerging populations capitalize on urbanization and industrialization trends, promoting economic inclusion and stability.

Turning the Tide: Why Action Matters Now

Policymakers can’t afford to wait. Addressing trade barriers, budget mismanagement, and labor market weaknesses offers a chance to reignite economic momentum, reduce inequality, and restore decades of development progress. The current slowdown is not a distant threat—it’s a global crisis that requires global solutions.

Trade Growth – Job Creation – Economic Development – Emerging Markets – Sustainable Growth

-

- Digital Literacy: The Cornerstone of an Inclusive Digital Future

-

May 13, 2025

Digital Literacy: The Cornerstone of an Inclusive Digital Future

Empowering People with the Skills to Thrive in a Connected World

Fatima Alvi

Digital Literacy: The Cornerstone of an Inclusive Digital Future

Empowering People with the Skills to Thrive in a Connected World

Date: 13/05/2025

In the age of rapid digital transformation, digital literacy is no longer a luxury—it’s a necessity. As more services, opportunities, and interactions shift online, the ability to navigate digital environments confidently and safely is fundamental to full participation in modern society.

From accessing education and employment to managing finances and engaging in civic life, digital literacy empowers individuals to thrive in the 21st century. Yet, millions across the globe remain digitally excluded due to limited skills, infrastructure, or access.

What Is Digital Literacy?

Digital literacy goes far beyond the ability to use a computer. It includes a broad set of skills:

- Navigating the internet

- Using digital tools and apps

- Evaluating online content critically

- Protecting personal data and privacy

- Communicating safely and ethically online

These competencies enable individuals to not only consume information but also create, collaborate, and participate meaningfully in digital spaces.

Why Digital Literacy Matters More Than Ever

The global shift toward digital systems in education, healthcare, government, and business has widened the digital divide. According to the International Telecommunication Union (ITU), around 2.6 billion people globally remain offline, many of whom are in low-income, rural, or marginalized communities.

Without digital literacy, people are at risk of falling further behind economically, socially, and politically. Digital skills open doors—to learning, employment, entrepreneurship, and empowerment.

The Gender Gap in Digital Skills

Women and girls are disproportionately affected by the digital divide. They are less likely to own digital devices, less likely to be online, and more likely to lack the confidence or training to use digital tools. The GSMA Mobile Gender Gap Report shows that women in low- and middle-income countries are 19% less likely than men to use mobile internet.

Closing this gap is essential for achieving gender equality and unlocking the economic potential of half the world’s population.

Education, Policy, and Partnerships: A Path Forward

To build a digitally literate society, we need an ecosystem approach—where governments, tech companies, educational institutions, and civil society work together.

Key strategies include:

- Integrating digital skills in school curricula from an early age

- Providing community-based training programs for adults and underserved groups

- Ensuring affordable access to digital devices and internet connectivity

- Developing inclusive content in local languages and formats

- Promoting digital safety awareness to combat misinformation and cybercrime

Digital Literacy for the Future of Work

In a world increasingly driven by AI, automation, and remote collaboration, digital literacy is foundational for employability. Basic skills are no longer enough—future-ready workers need to adapt to evolving tools, platforms, and ways of working.

Investing in digital upskilling and reskilling ensures that people aren’t just consuming technology, but using it to innovate, solve problems, and lead.

Conclusion: Leave No One Behind in the Digital Age

Digital literacy is the great equalizer of our time. When people have the skills to confidently use technology, they gain access to a world of opportunities. It’s how we bridge divides, boost economies, and create inclusive digital societies.

Now is the time for global action—because a digitally literate population isn’t just an advantage; it’s a requirement for a just, equitable, and sustainable future.

Digital Literacy – Global Digital Inclusion – Online Safety Awareness – ICT Skills – Tech Empowerment – Digital Divide

-

- Micro-Lending: Fueling Economic Resilience from the Ground Up

-

April 22, 2025

Micro-Lending: Fueling Economic Resilience from the Ground Up

How Small Loans Are Driving Big Change in Underserved Communities

Fatima Alvi

Micro-Lending: Fueling Economic Resilience from the Ground Up

How Small Loans Are Driving Big Change in Underserved Communities

Date: 22/04/2025

In a world where access to traditional banking remains limited for millions, micro-lending is emerging as a transformative force. By offering small, affordable loans to individuals who lack collateral or a formal credit history, micro-lending is not only helping people survive—but thrive.

From rural entrepreneurs in sub-Saharan Africa to urban artisans in Southeast Asia, micro-lending empowers individuals—particularly women and small business owners—to take control of their economic futures. These loans may be small in size, but their impact is anything but.

Why Micro-Lending Matters

Over 1.4 billion adults worldwide remain unbanked, according to the World Bank. Without access to credit, many are forced to rely on informal or exploitative lending systems. Micro-lending provides a safer, more empowering alternative.

Through microfinance institutions (MFIs), NGOs, fintech startups, and even peer-to-peer lending platforms, borrowers can access funds for everything from purchasing inventory and equipment to paying school fees or covering medical expenses. These loans unlock the potential for income generation and long-term financial independence.

Women at the Center of Microfinance

Globally, over 80% of micro-loan recipients are women. Why? Because research consistently shows that when women have access to financial resources, they invest in their families, communities, and businesses.

Programs like Grameen Bank in Bangladesh or BRAC’s microfinance initiatives have demonstrated that micro-lending to women not only boosts household income but also improves health outcomes, education levels, and community development.

In many cases, women form lending groups or cooperatives to share risk and build social capital—further strengthening economic resilience.

Digital Micro-Lending: A Fintech Revolution

With the rise of smartphones and mobile wallets, micro-lending has entered a new era. Digital micro-lending platforms powered by AI and alternative credit scoring are reaching remote populations faster and cheaper than ever before.

Companies like Kistpay are using mobile technology to offer instant, low-barrier loans—often with no paperwork, collateral, or bank visits required. These platforms assess creditworthiness using non-traditional data such as mobile phone usage, social behavior, and transaction history.

Such innovation reduces lending risk and brings millions into the formal financial ecosystem, particularly in Africa, South Asia, and Latin America.

Challenges and the Path Forward

While micro-lending has made tremendous strides, challenges remain. Critics argue that high interest rates, short repayment periods, and over-indebtedness can trap borrowers in cycles of debt. That’s why responsible lending practices, financial education, and borrower protections must go hand in hand with loan distribution.

There’s also a growing need for regulation and transparency, especially as the sector scales through digital platforms. Ensuring ethical lending models will be key to micro-lending’s sustainable impact.

Conclusion: A Micro Solution to a Macro Problem

In a time of widening inequality and economic volatility, micro-lending offers a pathway to financial inclusion, dignity, and resilience. It bridges the gap between survival and opportunity—empowering millions of people who have long been left behind by traditional finance.

The future of micro-lending lies in smart technology, ethical practices, and human-centered design. When done right, it doesn’t just lend money—it builds lives, fuels dreams, and strengthens economies from the ground up.

Micro-Lending – Global Microfinance – Digital Micro-Loans – Financial Inclusion – Fintech Lending Platforms – Mobile Loans

-

- Unlocking Economic Growth: The Power of Women’s Participation

-

March 18, 2025

Unlocking Economic Growth: The Power of Women’s Participation

Why Women Are the Future of Inclusive Economic Development

Fatima Alvi

Unlocking Economic Growth: The Power of Women’s Participation

Why Women Are the Future of Inclusive Economic Development

Date: 18/03/2025

In a rapidly evolving global economy, one truth is becoming clearer than ever: no nation can reach its full economic potential without the active participation of women. Across industries and regions, the data shows that empowering women to engage meaningfully in the economy isn’t just about fairness—it’s a smart economic strategy with far-reaching impact.

Women make up half of the world’s population, but they continue to be underrepresented in the workforce, underpaid in comparison to men, and often left out of financial and entrepreneurial ecosystems. Bridging this gender gap isn’t merely a social imperative; it represents a multi-trillion-dollar opportunity for global economic growth.

The Economic Cost of Gender Inequality

According to the World Bank, limiting women’s access to jobs, education, and capital has cost the global economy over $160 trillion in lost income and productivity. In many developing countries, cultural, legal, and institutional barriers prevent women from entering the workforce or starting businesses.

Even in more advanced economies, women often face a “glass ceiling” that restricts their career progression. Gender wage gaps persist, and caregiving responsibilities disproportionately fall on women—pushing many out of full-time employment.

By removing these barriers and ensuring equal access to economic resources, global GDP could increase significantly. McKinsey estimates that advancing gender equality could add $12 trillion to the global economy by 2025.

Why Investing in Women Pays Off

When women work, economies grow. Research shows that women reinvest up to 90% of their income back into their families and communities, compared to 30–40% by men. This creates a ripple effect—better education, health, and economic outcomes for future generations.

Furthermore, companies with higher gender diversity in leadership outperform their peers in profitability, innovation, and productivity. Empowering women as leaders, entrepreneurs, and innovators creates stronger, more resilient economies.

Closing the Digital and Financial Gender Divide

One of the biggest barriers to women’s economic participation is lack of access to digital tools and financial services. In low- and middle-income countries, women are 7% less likely to own a smartphone and 20% less likely to access the internet than men. The financial divide is even more stark: nearly 1 billion women globally are unbanked.

Digital and financial inclusion programs are now critical. Fintech companies like Kistpay, NGOs, and multilateral organizations are working to equip women with smartphones, digital literacy training, and access to mobile banking. When women can access finance and markets digitally, they are more likely to start and grow businesses—further accelerating development.

What Needs to Change: Policies and Mindsets

Real change requires a mix of supportive public policies, private-sector initiatives, and cultural shifts. Governments must create laws that guarantee equal pay, parental leave, property rights, and protection from discrimination. Private companies need to foster inclusive hiring, promote women into leadership, and invest in upskilling programs.

Just as importantly, society must rethink outdated gender roles and challenge norms that hold women back. Gender equity isn’t just a women’s issue—it’s a global economic priority.

Conclusion: Women Are Not Just Beneficiaries—They Are Economic Drivers

The path to a stronger, more inclusive global economy runs through the empowerment of women. When we invest in women—through education, technology, finance, and leadership opportunities—we invest in everyone’s future.

Unlocking women’s potential is not charity. It is sound economic policy, strategic investment, and the key to lasting prosperity.

Gender Equality Economy – Economic Empowerment – Financial Inclusion – Women Entrepreneurs – Gender Wage Gap – Inclusive Economic Growth

-

- Mastering Financial Management in a Fast-Changing World

-

February 27, 2025

Mastering Financial Management in a Fast-Changing World

How Smart Money Moves Today Can Secure Your Tomorrow

Fatima Alvi

Mastering Financial Management in a Fast-Changing World

How Smart Money Moves Today Can Secure Your Tomorrow

Date: 27/02/2025

In an increasingly volatile global economy, mastering financial management is no longer optional—it’s essential. Whether you’re an entrepreneur, a salaried employee, or a student just starting out, the ability to understand, plan, and manage your finances determines not just your economic stability but your ability to grow and thrive long-term.

From inflation and rising interest rates to unexpected global disruptions, financial unpredictability is the new normal. That’s why individuals and businesses alike are prioritizing strategic financial planning, risk management, and smarter investments like never before.

Why Financial Literacy Is More Crucial Than Ever

Financial literacy isn’t just about budgeting—it’s about making informed decisions across a range of areas: spending, saving, investing, borrowing, and planning for retirement. Yet according to global surveys, more than half the world’s adult population lacks basic financial knowledge, which leads to poor financial choices and long-term stress.

Improving financial literacy has become a worldwide goal, with governments, banks, fintech platforms, and even schools working to equip people with tools for smarter money management. Digital platforms like Mint, YNAB, and Kistpay are helping democratize access to personal finance tools that once required professional advisors.

Tech-Driven Financial Management: A Game Changer

Fintech has revolutionized the financial landscape. From automated expense tracking to AI-driven investment platforms, managing money has never been more convenient. Users can now monitor real-time cash flows, set personalized savings goals, access microloans, and even invest in global markets—all from their smartphones.

With AI algorithms analyzing user behavior, financial apps can now offer customized insights that help users build stronger habits. For example, if you’re overspending in certain categories or not saving enough for emergencies, platforms now send real-time nudges to keep your financial health on track.

The Importance of Emergency Funds and Diversification

The last few years have shown how quickly jobs can be lost, economies can stall, and markets can swing. Having a financial cushion—ideally covering 3 to 6 months of living expenses—is now seen as a cornerstone of financial resilience.

In addition, diversification remains one of the smartest strategies for financial protection. By spreading your investments across sectors, regions, and asset classes—like stocks, bonds, real estate, and even cryptocurrencies—you minimize risk and increase the potential for long-term gains.

Future-Proofing Your Finances with Long-Term Thinking

Short-term wins can be exciting, but sustainable financial wellness is built on long-term planning. This includes retirement savings, health insurance, debt reduction, and understanding your risk profile. Even small monthly contributions to retirement accounts or mutual funds can compound into significant assets over time, thanks to the power of interest and consistency.

In today’s climate, proactive financial planning is one of the greatest gifts you can give yourself—and your future.

Conclusion: Financial Freedom Starts with Financial Awareness

The tools are there. The knowledge is increasingly accessible. What’s needed now is the will to take charge. Whether you’re aiming for personal stability, entrepreneurial growth, or generational wealth, effective financial management is the key to unlocking your goals.

The best time to start was yesterday. The next best time is today.

Financial Management – Smart Money – Financial Literacy – Saving Money Strategies – Emergency Fund Planning

-

- Digital Wellbeing in the Age of Hyperconnectivity

-

January 19, 2025

Digital Wellbeing in the Age of Hyperconnectivity

How to Stay Human in a World That’s Always Online

Fatima Alvi

Digital Wellbeing in the Age of Hyperconnectivity

How to Stay Human in a World That’s Always Online

Date: 19/01/2025

In our hyperconnected, always-on world, digital technology has become both a lifeline and a double-edged sword. From virtual meetings and AI-powered productivity tools to 24/7 social feeds and app notifications, our lives are saturated with screens. While this connectivity powers unprecedented innovation and convenience, it also raises a serious question: What is all this doing to our wellbeing?

As digital tools infiltrate nearly every aspect of life—work, relationships, education, and even sleep—there’s a growing global movement focused on digital wellbeing: the mindful, balanced use of technology that enhances rather than erodes our quality of life.

The Burnout Generation: A Global Crisis

Remote work blurred the line between office and home. Smartphones made it impossible to “log off.” And with the rise of algorithm-driven content, we’re constantly pulled into digital rabbit holes that eat away at time and attention. The result? A global spike in digital fatigue, anxiety, sleep disorders, and mental health issues—especially among Gen Z and Millennials.

The World Health Organization has identified digital overexposure as a rising public health concern. The cost isn’t just mental—chronic burnout is now linked to physical issues like cardiovascular disease, vision problems, and reduced immunity.

Reclaiming Control: What Digital Wellbeing Actually Means

Digital wellbeing doesn’t mean ditching technology—it means using it consciously. It’s about setting boundaries, designing healthier online habits, and creating tech ecosystems that support, rather than undermine, human needs.

From turning off push notifications and using screen-time trackers to building in tech-free hours and prioritizing in-person relationships, people are rediscovering balance. Some companies are also introducing “right to disconnect” policies and wellness-focused UX design to address the problem at the root.

The Role of Big Tech in Protecting Digital Health

Tech giants like Apple, Google, and Meta are under increasing pressure to prioritize user wellbeing. Features like Focus Mode, Screen Time reports, and sleep tracking are steps in the right direction—but more needs to be done.

Designing apps that respect attention, reduce addictive features, and encourage breaks is not only ethical—it’s a competitive advantage in a market that’s waking up to digital burnout. Ethical design and humane tech are quickly becoming key differentiators in the digital product landscape.

A Global Movement for Digital Mindfulness

From Europe to Southeast Asia, digital wellbeing is emerging as a policy and education priority. Schools are teaching children about healthy screen habits. Companies are hiring Chief Wellbeing Officers. Governments are drafting digital wellness guidelines. It’s a shift from tech obsession to tech intention.

Global leaders are realizing that the future of technology is not just about speed and scale—it’s about balance and humanity.

Conclusion: From Hyperconnectivity to Hyperawareness

Technology isn’t going anywhere—but how we engage with it must evolve. Digital wellbeing is no longer a luxury or a personal trend. It’s a global necessity.

To thrive in the digital age, we must create space for silence, intention, and true connection. It’s not about escaping the digital world—but learning to live in it without losing ourselves.

Digital Wellbeing – Mental Health – Digital Burnout – Hyperconnectivity – Digital Detox – Healthy Digital Habits

-